What are the 3 biggest living expenses for households?

If you worked a full-time job in Australia in 1975, the average amount you would’ve earned a year was about $7,600, whereas today, that figure would be closer to $72,000, according to research by McCrindle.i

That’s welcome news, but while we’re earning more than what we did in 1975, things are also costing us more. A loaf of bread is 10 times the price, a litre of milk is three times the price, a newspaper is 20 times the price, not to mention petrol has doubled, with house prices in some capital cities up thirtyfold.i

We check out the largest contributors to household spending today and where people say they would source additional money if day-to-day expenses increased further.

Housing, food and transport

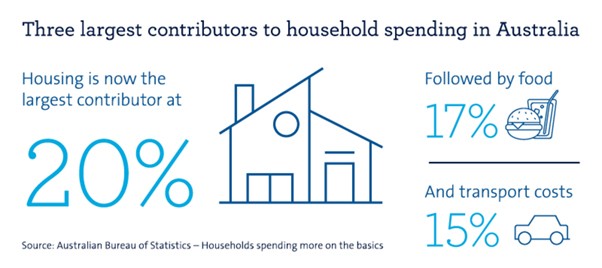

The three largest contributors to household spending in Australia have been the same for many years, according to the Australian Bureau of Statistics (ABS).

ABS figures reveal three-and-a-half decades ago the largest contributors to household spending were food (20%), transport (16%) and housing (13%), with housing now at the top of that list (20%), followed by food (17%) and transport (15%) respectively.ii

A separate report by Deloitte highlighted that around 37% of Aussies were concerned about their ability to cover expenses, with more than 50% indicating that they expected to pay even more on housing and energy costs going forward.iii

What people would do if costs rose further

When asked, if your day-to-day living expenses increased, where do you think you’d source additional money from, here was the top eight responses in a survey of Australians:iii

- Reduce luxury spending – 20%

- Buy fewer groceries – 12%

- Spend less on transport – 12%

- Borrow money via a loan or credit card – 10%

- Draw on savings – 5%

- Spend less on food delivery and eating out – 5%

- Cancel subscription services – 4%

- Cancel streaming services – 3%.

With costs of living continuing to increase, if you are feeling the pinch there is help at hand. We can review your situation and assist you to put in place a plan to get back on top of things.

--------------------------------------------------------------------------------------------------

i McCrindle Research – 40 years of change: 1975 to today

ii Australian Bureau of Statistics - Households spending more on the basics

iii Deloitte Access Economics – ALDI household expenditure report

© AMP Life Limited. First published October 2018